top of page

Search

Should you set up, retain or wind up a SMSF?

SMSFs are fantastic for the right clients, and terrible for the wrong clients. As Financial Planners, we are best placed to assess your circumstances and determine whether an SMSF would be right for you, and then provide you with ongoing guidance and support if they are.

Feb 254 min read

Should I retain my current house as an Investment Property when upgrading my home?

Should I retain my current house as an Investment Property when upgrading my home? We discuss two benefits and two disadvantages to consider of retaining the home as an investment.

Feb 113 min read

Interest Rate Rises - What they mean for your Financial Planning?!

The RBA has increased interest rates by 0.25% on the 3rd of February 2026 to combat higher than expected inflation.

Interest rate rises are:

Bad for those with mortgages as their repayments increase, and their surplus cashflow decreases.

Typically good for those who have finished paying off their home loan, as the interest rates on their fixed income investments (such as cash, term deposits and bonds) increase.

Feb 42 min read

The Value of Financial Advice

The value of Financial Advice comprises of Strategy, Product, Execution and Time and Effort Benefits.

Jan 203 min read

Financial Planning for Wealthy and High Net Worth People

Wealth brings opportunity, but it also brings complexity. For affluent Australians and high-net-worth individuals, Financial Planning is more than paying off the mortgage and saving for retirement; it’s about structuring wealth to live the life you want and to create a legacy.

Dec 10, 20253 min read

Should I sell or keep my investment property?

We help people decide whether to sell or keep their investment property based on a cost/benefit analysis and whether the strategy fits their wider goals and objectives.

Nov 20, 20254 min read

How are Financial Plans (Statements of Advice) Created?

A Financial Plan is the key deliverable of the Financial Planning Process. It contains the recommendations, reasons for recommendations, alternatives considered and financial modelling.

It helps show clients how the advice will put them in a better position.

Nov 5, 20252 min read

Shares (ETF’s) or Property: Which is the best investment?

As we have demonstrated, purchasing both ETFs and property can be a good strategy for you depending on the circumstances.

We have deliberately not concluded which performs better because the answer really is – it depends. The long-term average of quality high growth ETFs and quality investment properties is likely around ~9% per annum net, however the key word here is: quality.

Purchasing inferior investments can lead to a much lower investment rate of return.

Oct 27, 20256 min read

Division 296 Superannuation Tax Changes (Update 13/10/2025)

We are pleased to report that both of these issues have been addressed and that the proposed tax will no longer be applied to unrealised gains, and the cap will be indexed.

However, it is not all good news for high net worth individuals: The government has instead proposed an additional amendment that balances above $10m would incur tax at 40%.

This change is interesting because as the visual shows, for high net worth individuals, for the first time, superannuation could no

Oct 13, 20252 min read

Should you pay off investment debt before retirement?

When you retire after age 60, most people can convert their super to a tax free pension income account.

If you have no other personal investments, or the income generated is less than the tax free threshold (~$20,000) per annum, then negative gearing is no longer useful as you have no taxable income to be able to deduct.

Oct 10, 20253 min read

The 5 BIGGEST waste of money in Australia

By not paying enough attention, you could be leaking thousands of dollars a year in expenses that provide you no value! Think about all the things you could be doing with that money instead, and take action on eliminating waste!

Sep 30, 20252 min read

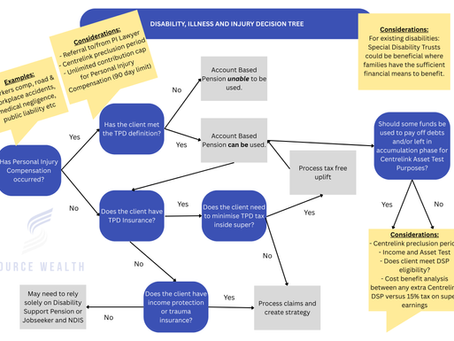

What should you do with a TPD and Personal Injury Payment?

When you have been through a serious personal injury, disability or illness it is imperative you receive financial advice to ensure you make the best decisions with your proceeds.

our role is to: Determine which strategy outcomes to take and to optimise, Minimise overall tax, often via the use of Account Based Pensions (where applicable), Minimise TPD tax (where applicable)

, Maximise Centrelink Disability Support Pension (where applicable),

Help people invest their money,

Sep 23, 20252 min read

FIRE (“Financial Independence Retire Early”) in the Australia

FIRE is a lifestyle and financial movement that focuses on achieving financial independence earlier than the traditional retirement age. We explore this movement in the context of Australia.

Sep 22, 20253 min read

Is $310,000 per annum the benchmark family income required for Financial Advice?

$310,000 per annum is of course an arbitrary number (albeit using the best average data possible) and we know that clients of all shapes, sizes and income levels perceive financial advice value in different ways.

There are many clients who may earn less than this figure and are happy to pay several thousand a year in Financial Advice fees for clarity, peace of mind and to improve their financial wellbeing.

Aug 28, 20253 min read

How much does the average family spend in Australia?

Our data reveals, the average family is also able to save $45,705 per annum. How do you compare?

Aug 28, 20252 min read

Understanding Aged Care and the Strategy Implications

Australia's ageing population is creating extra demand for Aged Care services. As such, we are seeing more clients (and most particularly their Powers of Attorney - often their adult children) reach out for financial advice. Aged Care is a complex, time consuming and often emotionally draining task, and we are here to help.

Aug 15, 20252 min read

The First Home Super Saver Scheme

The FHSSS can be a highly effective strategy for getting into the housing market quicker than saving in a bank account alone due to the tax and investment return benefits.

Jul 18, 20253 min read

Source Wealth Financial Wellbeing and Advice Need Assessment Report

Our Advice Need Assessment tool is available on our website and includes 10 weighted non-financial and financial questions to help us, and prospective clients determine whether they may be a good fit for Financial Advice, in under 3 minutes.

Jul 14, 20252 min read

What to do when you win the Lottery in Australia

It is estimated that 1 in 3 lottery winners end up running out of money within 3 to 5 years, because they do not have a clear Financial Plan to follow! A Financial Plan can help prevent: lifestyle inflation, pressure from others, poor investment decisions and strategy design.

Jun 19, 20254 min read

Which Generation had it toughest Financially in Australia?

Both generations views are correct in the context of their lived experience: the cost of housing has become more expensive and the cost of discretionary items has reduced.

Jun 10, 20253 min read

bottom of page