Source Wealth Financial Wellbeing and Advice Need Assessment Report

- Michael Sauer

- Jul 14, 2025

- 2 min read

Our Advice Need Assessment tool is available on our website and includes 10 weighted non-financial and financial questions to help us, and prospective clients determine whether they may be a good fit for Financial Advice, in under 3 minutes.

The data is fascinating for anyone in financial advice, the financial services industry, marketing, the prospective clients themselves or anyone wanting information about people's financial wellbeing.

Whilst we don't contend the data is officially a representative sample of the population, our website traffic does come from a diverse range of sources such as social media marketing, existing client and business partner introductions and local google searches.

Let's get into the results:

76% of people describe themselves as 'financially organised' whilst 24% do not.

76% of people want comprehensive financial advice whilst 24% only want advice on a specific area of their finances.

59% of people have a good understanding of their finances, whilst 41% have only a basic understanding of their finances.

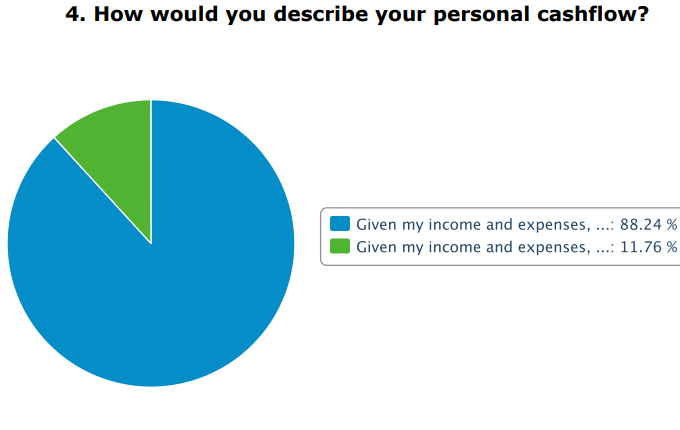

88% of people have the ability to save at least $1,000 per month, whilst 12% believe they do not have the capacity to do so.

70% of people have at least $200,000 of investable assets (including their superannuation balances) whilst 30% have below this level.

53% of people have a pressing need for financial advice, whilst 47% have no pressing or urgent need.

41% of people describe their financial situation as complex, whilst 59% of people describe it as fairly easy to manage and understand.

53% of people believe they are financially on track to meet their goals whilst 47% are either not sure or don't feel on track.

82% of people feel financially secure, whilst 18% of people feel financially insecure.

52% of people describe themselves as DIY'ers and like to find out information and make decisions themselves, whilst 48% of people prefer to delegate tasks to professionals so that they can spend more time on the things they enjoy.

The answers from these questions are then weighted by the importance to the overall Financial Advice Need. From this data we contend:

15% of people either have only a modest financial advice need or would be unlikely to benefit from Financial Advice given their financial situation, relative to the fees involved.

61% of people have a significant financial advice need.

23% of people have a crucial financial advice need. This is the cohort of clients who are likely to get the most benefit from Financial Advice as they have the financial means to turbocharge their wealth creation and are also likely to highly value the qualitative benefits that adviser's provide - such as giving people their time back and removing stress, confusion and anxiety from managing their own finances.

If you would like to give the Advice Need Assessment tool a go, you can find it at:

Comments